This article appeared originally in the November 2014 Levitt Letter.

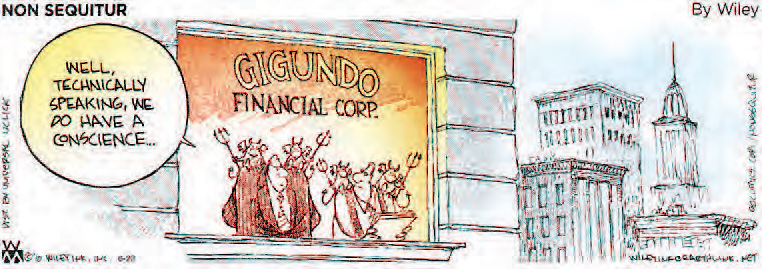

Politicians in the pockets of billionaires exchange favors for campaign contributions—a guaranteed return. By contrast, a pocket buyer (read: trusting investor) rarely receives much if anything—and certainly no guarantee—in return for the blind faith he puts in a stockbroker or other investment salesperson. In fact, his stock purchases, when combined with those of other dupes, can unduly exaggerate the value of junk.

After receiving eternal life for simply believing in Jesus, some Christians forget the enduring relevance of 1 Tim. 6:10: “For the love of money is the root of all evil.” Gullible heirs of lump sums or retirees with nest eggs fall easy prey when they assume that relying on almost any “advisor” is better than dealing directly with a self-service firm like The Vanguard Group.

In The Wolf of Wall Street film (2013), Leonardo DiCaprio played Jordan Belfort, a real-life silver-tongued stockbroker who grew wealthy foisting vastly overpriced stocks on naïve clients. The profanity-laced movie dramatizes how a stock brokerage systematically gathers pocket investors to drive up (“pump”) the value of shares it owns only to abruptly “dump” them, amassing obscene profits for themselves while impoverishing investors. I believe this is what happened to Zola, my family, and this ministry when we dealt with A.G. Edwards, a major corporation, whose underhanded behavior seem to profit from too little government regulation and protection for small investors.

Recent headlines uphold the wisdom of business columnist Scott Burns. A graduate of MIT, Burns advocates investing in broadly diversified index funds with low-cost firms like Vanguard or Fidelity. You can find links for the following partial list in this Levitt Letter online:

- “Financial Advice Usually Not a Good Investment,” Scott Burns, June 22. Burns’s analysis demonstrates that paying fees usually results in worse net results.

- “The Decline and Fall of Fund Managers,” Wall Street Journal, Aug. 23. Active fund management is outmoded, and a lot of stock pickers are going to have to do something else for a living.

- “How to Fire Your Adviser,” Wall Street Journal, Aug. 30. It’s okay; you don’t owe him anything.

Dozens of my bimonthly Serpent installments—archived on levitt.com (click on “essays” under the “information” tab)—fall into 8 broad categories such as “Homes,” “Cars,” “Stockbrokers,” and “Investing.”

- The “Stockbrokers” group contains articles like “A Fox Guarding the Henhouse,” “The Fiduciary Myth,” and “Of Muppets, Serpents, and Sharks.”

- The subheading “Investing” includes “A Book Review: The Only Investment Guide You’ll Ever Need,” “Saving, Spending, and Investing,” and “SEC Woes… Lazy Portfolios.”

Bottom line: Most investors are wise to speak with a non-commissioned Vanguard consultant who doesn’t pretend to be able to cherry pick individual stocks and bonds or specify when it’s best to enter/exit the market.